A Senate Republican wants to crack down on public officials who use their position to grow their wealth.

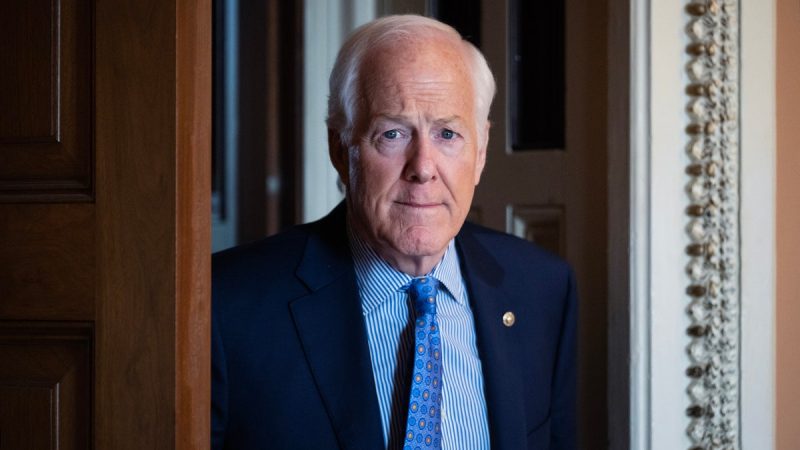

Sen. John Cornyn, R-Texas, is set to introduce legislation that would create stiffer penalties for public officials who commit federal bank fraud, tax fraud, or loan or mortgage fraud. Cornyn’s bill comes on the heels of two such instances where top officials and lawmakers were hit with allegations of mortgage fraud.

Indeed, Cornyn’s Law Enforcement Tools to Interdict Troubling Investments in Abodes (LETITIA) Act is named for New York Attorney General Letitia James.

The Justice Department earlier this year opened an investigation into James, who successfully won a civil case last year against President Donald Trump and his Trump Organization over allegations of faulty business practices, for alleged mortgage fraud.

Federal Housing Finance Director Bill Pulte alleged in a letter that James could have engaged in mortgage fraud by making false or misleading statements on property records, like a loan application that said her property in Virginia is her primary residence, a building record stating her multifamily Brooklyn property incorrectly has five residences instead of four, and a mortgage application that falsely stated James was her father’s spouse.

‘This legislation would empower President Trump to hold crooked politicians like New York’s Letitia James accountable for defrauding their constituents, violating their oath of office, and breaking the law, and I’m proud to lead my Republican colleagues in introducing it,’ Cornyn said in a statement.

Fox News Digital reached out to James for comment but did not immediately hear back.

Cornyn’s bill also comes after his colleague Sen. Adam Schiff, D-Calif., was similarly hit with allegations of mortgage fraud.

In another letter to the Justice Department, Pulte charged that Schiff falsified bank documents and property records by listing homes in Maryland and California as his primary residence out of an effort to allegedly get more favorable loans.

Marisol Samayoa, a spokesperson for Schiff, said in a statement to Fox News Digital that both Trump and Pulte’s ‘false allegations are a transparent attempt to punish a perceived political foe who is committed to holding Trump to account.’

‘The facts here are simple: Senator Schiff and his wife accurately represented to their lenders that they would occupy and use the Maryland house they purchased in 2003 as a ‘principal residence,’ rather than a vacation home or an investment property,’ she said. ‘He also disclosed to his lenders – repeatedly – that he maintained another home in his district in California, where he lived when not in Washington, and which was also a principal residence, not a vacation home or an investment property.’

‘This was done in consultation with relevant House counsel. As was proper, he claimed only a single homestead tax exemption (from California) worth approximately $70 in annual savings,’ she continued.

The bill, which is so far co-sponsored by six Senate Republicans, would increase federal statutory maximum sentences and fines for public officials who abuse their offices and violate the public trust to commit bank fraud, loan or mortgage fraud, or tax fraud.

It would create new mandatory minimum sentences, including one year for bank fraud, one year for loan or mortgage fraud, and six months for tax fraud. And if a public official engages in a repeated pattern of offenses, minimum sentences increase to five years for bank or loan fraud and two years for tax fraud.